February 21, 2015, 6:14 pm

The raw fish salad is a 'unity forging' appetizer eaten together in big groups during Chinese New Year. The higher its freshly prepared ingredients are tossed in the air with chopsticks, the better your luck!

Yu sheng (鱼生) sounds like the Chinese word “abundance” and eating it is considered a symbol of prosperity and vigour. When the yu sheng is served on the table, New Year greetings like gong xi fa cai (恭喜发财) meaning “congratulations for your wealth” and wan shi ru yi (万事如意) “may all your wishes be fulfilled” are offered.

Since Malaysia is multi-cultural, restaurants are serving yu sheng with the gustatory traits of Thai, Japanese, Indian and Peranakan cuisines. Halal and vegetarian versions are also available to meet any diner’s requirements.

In welcoming good luck and blessings, here's a 10-step guide to Lo Hei:-

1. Add the fish, usually thinly sliced local snakehead fish (in Cantonese, it is called sang yue) or if you like, salmon. Nian nian yu yue (年年有余) means “abundance year after year”, as the word “fish” in Mandarin also sounds like “abundance”.

2. Add the pomelo pulp, which symbolises adding luck and auspicious value. Da ji da li (大吉大利) means “good luck and smooth sailing”.

3. Add a dash of pepper, which symbolises the hope of attracting more money and valuables. Zhao cai jin bao (招财进宝) means to “attract wealth and treasures”.

4. Pour the palm cooking oil, circling the ingredients to encourage money to flow in from all directions. Yi ben wan li (一本万利) means “Make 10,000 times of profit with your capital”. Cai yuan guang jin (财源广进) means “numerous sources of wealth”.

5. Add the carrots, which indicate blessings of good luck. Hong yun dang tou (鸿运当头) means “good luck is approaching”.

6. Add the shredded green radish, which symbolises eternal youth. Qing chun chang zhu (青春常驻) means “forever young”.

7. Add the shredded white radish, which symbolises prosperity in business and promotion at work. Feng sheng shui qi (风生水起) means “progress at a fast pace” and bu bu gao sheng (步步高升) means “reaching a higher level with each step”.

8. Add chopped peanuts and sesame seeds, which symbolises flourishing business. Sheng yi xing long (生意兴隆) means “prosperity for the business”.

9. Add the plum sauce, generously drizzle over the entire dish. Tian tian mi mi (甜甜蜜蜜) means “may life always be sweet”.

10. Add deep-fried flour crisps, which come in the shape of golden pillows and symbolises a floor filled with gold. Man di huang jin (满地黄金) means “floor full of gold”.

↧

February 24, 2015, 11:52 pm

As relatives gather to celebrate Chinese New Year, news of ... newly-born babies, health of new mothers, death of elderly folks, career changes, new boyfriends and girlfriends brought into the family ... are usually raised.

A few distant relatives of mine had just given birth to big, bouncy babies.

As usual, the elders will dish out advice of special diets that promotes would healing during the month following childbirth.

The haruan fish (“sang yue” in Cantonese) is believed to have 'magical' wound-healing properties.

The elders specifically “prescribed” sang yue for women who had just given birth or anyone who has had to endure painful wound surgery.

A quick search on some scientific papers on the Internet revealed that sang yue contains high levels of essential amino acids and a good profile of fatty acids that improves tissue growth and speed up wound healing. Wow!

As the conversation among the elders get more intense, they drill into me that sang yue can be stirfried and cooked as nutritional soup.

As the only journalist in the family, I was tasked to 'put it down in record'. Since I was lazy to take notes or even use my smartphone to video-record, I willed myself to remember as much as I can. Ha! Ha!

In making the 'magical' soup, the sang yue is usually sliced into fillets and double-boiled with herbs and a sprinkle of palm cooking oil.

This time-consuming process is necessary to distil the fish's medicinal properties. Mmm ... the sang yue soup is delicious to the very last spoonful!

The elders noted sang yue taste just as good when stir-fried and the best cooking oil that is heat stable is palm oil.

When stir-fried in quick high heat, every slice of the sang yue fillet turns out to be tender and succulent. The fragrant ginger and spring onion garnishings enhances the freshness of the fillet.

↧

↧

I was feeling bored and decided to get myself some coffee. Instead of heading to the usual place that has a green mermaid logo, I turned off to a different coffee place.

When I placed my order for latte, the barista stared at me and then squinted her eyes, "you look familiar."

After a couple of seconds, she squealed, "I know! I know! You're Snow White." [Click here]

I smiled at the barista, who used to work at the neighbouring green mermaid logo coffee outlet and replied, "Today ... you cannot asked me about my seven dwarfs."

"Why?"

I swooped my head around like that in a shampoo advertisement and replied in a breathless whisper, "because today ... I'm Rapunzel."

She laughed hysterically as my shiny and luscious locks swooshed around in slow motion and fall over my shoulders.

We talked for a while. She was amazed to 'discover' that there's healthy palm specialty fats in a cup of latte.

Today is not such a boring day after all.

↧

I recently join in a Chinese New Year Yee Sang toss with a few senior executives of an oleochemical company. Excluding myself, there were four ladies and a man.

Since women outnumbered that one man at the Yee Sang gathering, the conversation naturally turned to women's struggle for work-life balance.

With increasing cost of food, housing, education, healthcare and telecommunication, most family need to have two breadwinners.

Many women work to help contribute to household expenses which often include hired help, such as live-in maids or part-time cleaning services.

Some women are lucky to be able to rope in their parents to help with sending of children to school so that they are able to focus on their career, knowing their children are in safe hands.

Depending on the nature of the job, forward thinking employers would encourage use of Internet phone calls and emails for colleagues to stay in touch with superiors.

That way, employees are still able complete basic work tasks while attending to an urgent family matter.

I have utmost respect for women who give it their all to their family and career.

This blog posting is dedicated to women who work hard for the money.

This 1980s video of Donna Summer performing "She Works Hard For The Money" was shot at the family-friendly Disneyland in Los Angeles, USA.

Can you spot Snow White and the Seven Dwarfs?

↧

Chap Goh Meh, which is Hokkien for “15th night” marks the end of celebrating the lunar new year.

Tonight, at many popular tourist seafronts, you'll see a quaint tradition.

The elders will tell you in Hokkien that single ladies “tio beh ai tim ho kam, jia eh thaan ho ang.” Basically, this translates to “must throw good quality Mandarin orange to marry a good husband".

*Please take note: The oranges thrown into the sea must be Mandarin Oranges, imported from China (Sunkist from California do not count).

In Malaysia, this day of full moon is increasingly regarded as the Chinese version of Valentine's Day.

Many single ladies inscribe oranges with their names, phone numbers and throw them into lakes or ponds. Single men hoping to meet a romantic interest will paddle up in their boats with nets to fish out the oranges.

This decades old romantic practice of throwing oranges on Chap Goh Meh did not originate in China but is a peculiar Penang tradition.

In modern times, the throwing of oranges into the sea in fervent hopes of 'landing' a husband has evolved into a fun activity, rather than a superstitious belief that the man who picks up the girl’s floating Mandarin orange would be her future spouse.

Many single ladies write good wishes on their oranges, while others are just looking to have fun.

Granted, there are some who are looking fort true love, whether or not they believe in the likelihood of it happening through a chance introduction of a mandarin orange!

That indelible ink inscribed on the surface of the mandarin oranges, which may spark romance, is made possible by oleochemicals.

So, it's true. Never under-estimate the might of the pen, especially when it is filled with oleochemical-derived palm oil.

↧

↧

KUALA LUMPUR: Prime Minister Datuk Seri Najib Razak graced Media Prima Bhd's Chinese New Year open house celebration here today.

Najib was met on arrival by Media Prima Bhd (MPB) chairman Tan Sri Johan Jaaffar and New Straits Times Press Bhd (NSTP) chairman Tan Sri Mohamed Jawhar Hassan. They were greeted with much fanfare with thunderous lion dance and traditional drum troupe performance.

Najib joined the guests in tossing the Yee Sang to signify the wish for abundant prosperity, good luck and happiness for all.

In reference to the `Yee Sang’, Najib said this festive dish might appear in a mess when people tossed it, but it tastes very good.

“Malaysian community may look a bit like that, but at the end of the day, we have the uniqueness and strength of the Malaysian nation represented by so many ethnic groups. We come together as 1Malaysia.”

Najib said the underpinning values associated with diversity, especially the concept of 1Malaysia, mattered.

“I respect your culture, lifestyle, religion, and language, and you respect my language, religion and my way of life. That is the underpinning values," he said.

Among those who participated in the tossing of the Yee Sang were Second Education minister Datuk Seri Idris Jusoh, Media Prima non-independent non-executive director Tan Sri Lee Lam Thye, Chinese Ambassador to Malaysia Dr Huang Huikang, Johan, Hua Zong president Lim Gait Tong, Jawhar and MPB chief marketing officer Shareen Ooi.

Also present were MPB group managing director Datuk Seri Amrin Awaluddin, Media Prima Television Networks chief executive officer Ahmad Izham Omar and Media Prima Radio Networks chief executive officer Seelan Paul.

↧

Today is International Women's Day. It gives a reminder to the world of women's contribution in the caring of their family, toiling in the agricultural fields and assembly factories, to heading billion dollar companies.

Wives, mothers, grandmothers, sisters, daughters, girlfriends, teachers, friends, and co-workers are all worthy of this recognition.

Men and women are different in their strength and weaknesses.

If you have the privilege to visit palm oil mills, you'll see tasks that require brute strength are carried out by men. Women are more detailed in their approach. They tend to excel in tasks that involves considerable listening, persuasion and nurturing.

Today, there are increasingly more opportunities for women to be in top decision-making positions.

Women of substance ... those who are able to figure out and understand the big picture and not be overwhelmed by small details ... they are the ones who win the confidence and loyalty of their colleagues.

Women at the top, who execute their duties responsibly, inevitably earn respect from their colleagues and clients. They have many fans and admirers.

On the other hand, women who choose to be selfish and cowardly, tend to lose respect from people around them.

Some people say I'm childish to use this analogy but I think Spiderman is right when he said, "with great power comes great responsibility."

Today is also the anniversary of the tragic MH370 disappearance. Loved ones of the victims have suffered indescribable pain. Let us take a moment to pray for a hopeful outcome and better tidings ahead.

↧

KUALA LUMPUR: Genting Plantations Bhd's plans to partner the world’s largest refiner Musim Mas Group to set up a RM300 million palm oil refinery in Sabah is well-received.

Public Investment Research (Public Invest) said this marks the maiden refining venture for Genting Plantations, which will eventually see the group shifting from being a pure upstream plantation player to an integrated one.

"We laud Genting Plantations's move as it can reduce the group's high exposure to the fluctuation of crude palm oil prices and help provide steadier recurring income in the future," Public Invest said in its notes to investors.

Public Invest rates Genting Plantations' stock as "outperform" with a RM11.73 target share price from RM10.00 at present.

Both parties will set up a joint venture called Alfa Raya Development Sdn Bhd, with Genting Plantations and Musim Mas owning a 72 per cent and 28 per cent stake, respectively.

The refinery, which will be completed by the second half of 2016, will have 600,000 tonnes of production capacity per annum.

"This will be a synergistic tie-up as Genting Plantations can ride on Musim Mas' vast experience in the refining industry.

"Musim Mas is one of the biggest players in the vegetable oil refining and soap manufacturing player in Indonesia and it also owns the largest palm oil refinery in the world," it said.

This tie-up allows for Musim Mas to expand its footprint in Malaysia's palm oil industry, having bought over a biodiesel plant in Johor last year.

Genting Plantations chief executive Tan Sri Lim Kok Thay said this refinery will be part of the group's Integrated Biorefinery Complex in the Palm Oil Industrial Cluster in Lahad Datu.

Indeed, Genting Plantations is investing big time in the downstream value chain to produce higher-margin products.

↧

Dehydration can affect every skin type and age, especially those who are in frequent contact with chlorine in the swimming pool.

The video above is that of Malaysia's synchronised swimmers Katrina Ann Hadi and Xylane Lee competing in Germany. It takes a lot of breath-holding endurance to twirl in the water upside down.

Many swimmers are in the pool of chlorinated water at least five hours a day. It can take a toll on their skin and hair.

Skin dehydration is the loss of water in the skin and occurs when the skin loses more moisture than it takes in.

This is worsened when our skin is subjected to prolonged exposure to the sun, poor skin hygiene, air conditioning or even harsh-perfumed soap.

Our skin moisture constantly needs replenishing and preservation. Make sure you drink plenty of water, avoid smoking and generously slather on blobs of lotion on your skin after a shower.

Moisturise regularly with palm oil-based body cream to soften and soothe your sensitive skin.

↧

↧

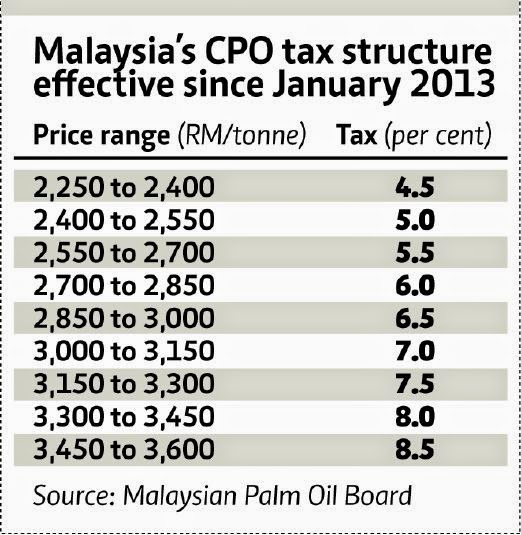

BANGI, Selangor: MALAYSIA will impose a 4.5 per cent export duty on crude palm oil (CPO) for April 2015, after seven months of duty-free CPO since September 2014, following higher prices.

The CPO price averaged RM2,288.41 a tonne in the past month, which surpassed the threshold for CPO tax of RM2,250 per tonne.

“Since the average pricing in the past month is well within the RM2,400 a tonne bandwidth, the CPO tax is 4.5 per cent,” said Plantation Industry and Commodities Minister Datuk Amar Douglas Uggah Embas.

Refined palm oil will, however, remain tax-free, the minister told reporters after hosting a visit by Iranian Members of Parliament to the Malaysian Palm Oil Board headquarters, here, yesterday.

To recap, should the next one-month trading of CPO ending April 15 averages below RM2,250, there will be no tax on CPO exports for the month of May.

Malaysia’s multi-tiered CPO export tax, effective since January 2013, is structured in such a way to mimic Indonesia’s.

The Palm Oil Refiners Association of Malaysia (Poram) had previously said that Malaysia’s CPO tax structure needs to move in lock-step with Indonesia.

That way, Malaysia’s refiners can continue to compete on a level playing field and hopefully, oil palm planters in both Malaysia and Indonesia can avoid the dreaded price war.

If Indonesia was to widen the tax gap between crude and refined oil by a certain percentage, Malaysia’s CPO tax should be immediately amended to match the gap. This will allow oleochemical and specialty fats producers here to also benefit from the competitive prices.

Analysts see the government’s move as a commitment to ensure “a level playing field with rivals” to maintain the country’s export competitiveness. Many foreign and local downstream investors have injected billions of ringgit in investments to produce specialty fats, specialty oleochemicals and fine chemicals.

Maybank Investment Bank analyst Ong Chee Ting said: “We believe this CPO tax imposition is positive for the industry as this brings hope that exports for processed palm oil could pick up again from April 2015, after a sharp decline in recent months.”

“The CPO export tax will give refiners some incentives to ramp up utilisation rates which fell below 50 per cent in February 2015,” the analyst added.

From August 2014 until February 2015, CPO prices traded on lacklustre sentiment, averaging below the tax threshold of RM2,250 per tonne. Yesterday, the third month benchmark palm oil futures on the Bursa Malaysia Derivatives market closed RM37 lower at RM2,199 per tonne.

Brokerage KL Palm Services Sdn Bhd, which deals with traders from plantation companies of Malaysia and Indonesia as well as palm oil buyers in China, India, Europe and the United States, highlighted pessimistic palm oil prices for the past couple of weeks.

“Palm oil prices are likely to be under pressure from weak demand because there is still ample stocks at consuming countries. So far, Malaysia’s palm oil production is good. We foresee double-digit growth in output until May,” said KL Palm Services managing director Ling Chen Eng.

“For Indonesia, we estimate palm oil production to pick up from April until July. Palm oil stocks in Malaysia and Indonesia are expected to build up fast in the next few months,” he said.

“Currently, we see many large trading companies placing long positions in their books. We think CPO prices are not likely to rise as long as refiners and oleochemical producers suffer from negative processing margins. How many sectors do you know of that can survive in this scenario?” Ling asked.

↧

BANGI, Selangor: Malaysia's palm oil exports to Iran plunged 42.1 per cent to 447,058 tonnes in 2014 from 635,258 tonnes in 2013, said Plantation Industries and Commodities Minister Datuk Amar Douglas Uggah Embas.

"Iran cut down in its palm oil purchase and this was due to recent restrictions and discriminatory policy against palm oil," he told reporters after receiving a courtesy call from the Iranian Members of Parliament here yesterday.

The Iranian delegation was lead by Iranian Parliament head of Education and Research Commission Mohammad Mahdi Zahedi.

The Iranian lawmakers were here to find out the facts and figures of palm oil nutrition and discuss ways to reduce trade imbalance between the two countries.

Uggah said he plans to meet up with Iran's Health Minister Hassan Ghazizadeh Hashemi sometime soon.

The Iranian government had reportedly cast doubts on palm oil nutrition and mistakenly equated saturated fats in palm oil to the deadly artificial trans fat found in hydrogenated soft oils.

Uggah said he has tasked the Malaysian Palm Oil Board (MPOB) and Malaysian Palm Oil Council to carry out joint research on edible oils nutrition, of which the Iranians can verify for themselves what are factual and what are myths.

On another note, Uggah said a new standard operating procedure on curbing the crime of stealing fresh fruit bunches (FFB) in Sarawak would be implemented from next month.

"The police will take a more serious approach in enforcing against FFB theft. We view this seriously as it affects investors confidence and result in loss of tax collection to the government," he added.

About 250 cases of stolen FFB in Sarawak were reported in 2013, causing tens of millions ringgit in losses in the oil palm industry.

Last year, the MPOB issued 278 compounds and at the same time, terminated three business licenses and suspended 24 others, while imposing eight compounds on those found abetting pilferage of oil palm fruits.

It also issued six warning letters to those found guilty of such wrongdoing.

↧

Last month, 83-year-old Datuk Leslie Davidson gave an introductory talk at the opening of the Faces exhibition by Malaysian photographer Amri Ginang at London, the United Kingdom.

Davidson had an illustrious career as a planter in Malaysia during his younger days.

In 1960, Leslie Davidson arrived in Sabah to open Tungud Estate in the Labuk Valley on behalf of his employer, Unilever Plantations.

By the 1970s, faced with unproductive yields at his employer's oil palm estates, he vowed to turn things around.

Unlike other estate managers, Davidson was not convinced that palm fruits were wind pollinated despite some high ranking scientists telling him heavy rains were washing the pollen away.

True to his curious and rebellious streak, he made a resolution to "get to the root of the problem".

Davidson initiated a radical taskforce to go on a fact-finding mission to Cameroon, in West Africa, despite scepticism from many in the oil palm industry.

His gut feeling "for a second opinion" proved fruitful when the group of scientists found out that oil palms were pollinated by insects called weevils.

His sceptics were shocked. They had to swallow their pride and eat humble pie. Davidson is not that "crazy" after all.

The migration and breeding of these hard-working weevils to Malaysia was the turning point for the oil palm industry.

Below are Davidson's thoughts ... in his own words.--------------------------------------------------

I recently joined photographer Amri Ginang and other invited guests at the opening night in paying tribute to the rural farmers of Malaysia.

Anyone who studies these sensitive photographs will see that Amri is passionately involved with the rural and agricultural population of Malaysia. Both he and members of his family have been engaged in the growing of oil palms for some years which is why some of the portraits are of oil palm smallholders.

I myself have also been involved in the oil palm industry, in my case since 1951. For the first 24 years I was a planter in Johor, Sabah, Nigeria and Cameroons, and thereafter, as Chairman of UPI, in London, with the responsibility for plantations in 15 tropical countries in South America, Africa, and Asia.

This has given me a unique opportunity to compare the spectacular economic progress of Malaysia with many other developing countries.

I was pleased to learn that Amri is a Sabahan by birth, I lived with my family in the interior of Sabah for ten years and my daughter Mary Anne was born in Sandakan.

Also displayed at the exhibition were some copies of my book East of Kinabalu which tells of the early pioneering days in Sabah, and of the amazing multi-racial group of people with whom I worked in the Labuk Valley.

Perhaps I can read an extract from the Preface: “This book does not set out to be an official history. It has been written largely as an affectionate tribute to some of my old Sabah friends who were involved in the project.

Their names will not be found in the pages of any history book. They are the people whom Rudyard Kipling calls: "Not the rich nor well bespoke, but the mere uncounted folk, of whose life and death is none report or lamentation.”

Nevertheless, they all played a part in the pioneering days of the oil palm in Sabah. Sadly, all of these friends I mentioned in the preface are now dead and I must say so I am getting near to the age when I am due for replanting.

I would like to tell you something about them, and their children and grandchildren, with whom I am in frequent contract through Facebook. Many are still connected with the oil palm industry. It is a great pleasure to see how well they have prospered, over the years.

I must also say a few words about the role the oil palm has played in the economic development of Malaysia. My friends would, I know, be shocked and disappointed to learn that the oil palm which played such a beneficial role in their lives is depicted by the UK media as being something akin to the Black Death.

Over the past fifty years, the oil palm industry has become the backbone of the Malaysian economy, directly providing employment to over 800,000 workers in plantations and smallholdings. Importantly these jobs are in the heart of the countryside thus stemming the urban drift which is such a major problem in many tropical countries.

At a time when civil war and violence is rampant throughout the countries of the Middle East and Africa, the stabilising effect of the increased rural prosperity in Malaysia and Indonesia, the region with the highest Islamic population in the world, is something which has often been largely ignored by the Western media.

In terms of food production, the growth of the oil palm industry in Southeast Asia has been the greatest success story in the history of Tropical Agriculture. The oil palm produces more oil per ha. than any other oil crop. That is 10 times more than soya bean.

It produces 32% of the world’s oils/fats but uses only 5.5% of the land under oil crops. The production from Malaysia in 2014 was close to 20 million tonnes. Over 30% of this is produced by smallholders. This provides the basic vegetable oil requirements for 1.3 billion Asian people, at current rates of consumption.

However, the development forced the Malaysian government to make some difficult decisions on the balance between poverty on the one hand and the environment on the other.

What is most satisfying ecologically is that this quantity of food is being produced from a perennial tree crop which provides a year-round sustainable cover and which has nearly the same rate of consumption of CO2 as tropical rainforest.

One wonders how the requirements of the above 1.3 billion people would have been met if Malaysia had been preserved as a giant nature reserve, serving as a pleasure ground for eco-tourists from Europe.

Hundreds of thousands would be unemployed and millions throughout Asia would have suffered from serious malnutrition and relying on food hand-outs from the West.

It is an interesting thought that if the Malaysian Government had decided to plant soya bean as Brazil did, rather than palms, it would, to produce the same quantity of vegetable oil, have meant the felling of almost the entire forests of the country.

As it is, today oil palms occupy only 15% of Malaysia’s ground area. With 62% of forest cover it is still the second most heavily forested country in the world. The millions of ha of forest provides for Malaysia’s abundant wildlife.

It is a striking fact that there is no evidence of the extinction of a single species of wildlife in Malaysia: unlike the situation in UK where the powerful agricultural lobby has over the centuries brought about the extinction of such mammal species as wolves, beavers, reindeer and some species of bird life, like the Sea Eagle.

As a keen environmentalist, I believe that the introduction of the oil palm, by diverting peasants from earning their daily bread by growing low yielding annual crops, has done more to save the remaining jungles of Malaysia than any other factor. The motto of the green parties should be “Save the forests, – grow oil palms."

Perhaps however rather than by statistics, the impact of the oil palm on the rural scene might be better demonstrated by looking at the affect it has had on one rural area namely the Labuk Valley, and its inhabitants.

When I arrived in the colony of North Borneo in 1960, to develop a plantation on a long abandoned Tobacco estate, no palm oil had been produced from anywhere in Borneo.

The Governor, Sir William Goode told me that the Labuk Valley was the least developed region in the state and ,in fact, a great embarrassment to the Colonial Government.

The Tobacco estates had closed down in 1904, leaving the land to revert to scrub or secondary forest. Their ex-workers, mostly from Indonesia were simply abandoned and left to fend for themselves.

The locals, scattered along the riverbanks were desperately poor. They survived by growing small patches of hill paddy and collecting jungle produce like rattans, bamboo and damar. I calculated that this provided them with an income of less than 50 cents a day.

Health conditions were very bad: malaria and intestinal disorders were endemic. There were no medical or dental facilities. Since there was no school in the region upstream from Klagan, the literacy rate was close to zero. There was no road access. This would seem to be the exact scenario which the European NGOs are campaigning for.

The injection of several million dollars in wages in the first 10 years produced an amazing transformation. The difference between a plantation investment and an industrial investment is that the initial expenditure does not go into importing machinery, but on hand clearing, draining, road making, and planting which puts wages directly into the hands of the workers.

Some of the locals were directly employed by us. Others started to earn a good income growing vegetables for selling to our multi-national labour force. In later years they became oil palm smallholders.

If Sir William Goode could see the region as it is today, he would be amazed. The Labuk is now one of the most busy and prosperous areas in the State, connected by road to Sandakan, and Kota Kinabalu. There is now an airstrip, a post office: a large and thriving secondary school, with a computer section, and a cottage hospital providing emergency medical and dental facilities. Malaria has been completely eradicated.

To see how this prosperity has affected the locals, let me tell you about my friend Tasman who is mentioned many times in my book. He was my very first employee. He was the grandson of one of the Banjarese Indonesians brought over by the tobacco company in 1898.

Tasman was a very intelligent man, whom I admired. After a few years in our employment, rising to become a senior overseer, he left us to go into business. He got a loan from us to purchase a kumpit and he earned good money shipping our kernels to Sandakan port. In 1970 he planted a 50 ha. smallholding at Kampong Bayok down river.

The palms grew well but when they matured many of the flowers were not pollinated and bunches simply rotted on the trees. Yields were very low. The palms had to be hand-pollinated which was expensive.

The oil palm was not a profitable crop and no other locals wanted to plant palms in the Labuk. When our company solved the problem by bringing pollinating insects from Africa in 1980, it spread rapidly to every palm in the country. Yields improved dramatically, and the palms provided Tasman with a steady income. Many more smallholders then took up the crop.

Tasman and I remained friends long after I left the Labuk. I was so proud when he sent me an extract from the local paper announcing that he had won a prize from the MPOPA for having the highest yield per ha. of any Sabah smallholder.

When he died three years ago at the age of 81, he was a prosperous man. He had been to Mecca three times; He owned a town house in Sandakan; Two of his daughters were col|ege-educated, and his eldest son had become a Police Inspector.

I could go on to tell you the histories of my Malaysian friends.

Titi’s daughter Susan now owns two restaurants in London. Ah Moi, the niece of Tumpeh is a very successful business woman, on the board of a company in Japan.

Kunganathen’s eldest son Sangarasingam is the G.M of a large Plantation Co. in Indonesia. He sent his daughter Shobana to study law at Lincoln’s Inn in London and she is now a lawyer in KL. I got a photo of her new baby boy Sachin recently. This made me feel very, very old since Sachin’s great-great-great grandmother was working on Pamol Kluang when I started there as a trainee in 1951.

If not for the success of the oil palm, Malaysia’s golden crop, all of these people would still be scraping a living from jungle produce in the Labuk Valley.

The Faces exhibition in London captures the spirit of the rural people of Malaysia better than I have tried to do in a thousand words.

↧

Currently, cooking oil sold in Malaysia is subjected to the 10 per cent Sales and Services Tax.

After 1st April, this tax will be replaced with the 6 per cent Goods and Services Tax.

Hopefully, consumers can expect to see cheaper cooking oil at the supermarket shelves and grocery stores.----------------------------------------

PETALING JAYA: Domestic Trade, Co-operative and Consumerism Ministry warn businesses against profiteering from consumers in view of the Goods and Services Tax (GST) kicking in from April 1.

"Certain items that are now subjected to 10 per cent Sales and Services Tax (SST) should revise their products pricing accordingly when this is replaced by the 6 per cent GST from April ," said the ministry's senior principle assistant director Guna Selan Marian.

"By right, we should see cheaper pricing provided there are no increment in costs. It is an offence for businesses to manipulate prices and unreasonably profit from this," he told reporters after presenting his papers at the Deloitte Malaysia Price Control and Anti-Profiteering seminar here yesterday.

"Among consumer goods that will see reduction in tax quantum as a result of the SST being replaced by GST are cars, clothings, select food items and home appliances," said Deloitte Malaysia managing director/country tax leader Yee Wing Peng.

The tax consultant added the GST's input and output mechanism will allow the government to act on complaints by tracing the entire supply chain for elements of profiteering.

Section 14 of the Price Control and Anti-Profiteering (PCAP) Act 2011 states that anyone, in the course of trade or business, “profiteers” in selling or offering to sell, or supplying or offering to supply, any goods or services, commits an offence.

The law defines “profiteering” as making unreasonably high profit.

Section 18 of the PCAP Act states individuals guilty of profiteering will be fined RM100,000 or face jail time for three years or both. Repeated offenders will see a higher penalty of RM250,000 or five years of incarceration or both.

Corporates found guilty of profiteering will be fined RM500,000. If it is found to be a repeated offence, the penalty is raised to RM1 million.

Since the start of the year, Guna Selan said his ministry had embark on 'Ops Catut' to enforce against profiteering. In addition to introducing the Shoppers Guidebook, the government has open the 1-800-88-6800 hotline to receive consumer complaints.

"The government will always look after consumer interests and protected their rights. We have until end June 2016 to enforce against sudden higher profit margins arising from profiteering," he said.

It was previously reported that the Domestic Trade, Co-operatives and Consumerism Ministry Secretary-General Alias Ahmad said Phase one of Ops Catut is being carried out in the first quarter of this year.

More than 450,000 trading premises were checked and enforcement officers seized RM426,857 worth of goods and issued fines totalling RM279,166.

The second phase of the anti-profiteering enforcement exercise will be introduced on April 2. It will involve some 1,800 enforcement officers.

↧

↧

New York:– Reuters – Ketchup maker H.J. Heinz Co, backed by Warren Buffett's Berkshire Hathaway Inc and Brazilian private equity firm 3G Capital, will combine with Kraft Foods Group Inc in a US$46 billion (RM169 billion) deal to create the third-largest North American food company, executives said yesterday.

Shares of Kraft, known for its namesake macaroni and cheese in a box, as well as Velveeta, Maxwell House coffee and Oscar Mayer processed meats, closed up nearly 36% at US$83.17.

The deal gives Buffett more leading US food brands, as well as that of 3G founder Jorge Paulo Lemann, Brazil's richest man. The two teamed up to buy control of Heinz in 2013 and collaborated on the 2014 merger of fast-food chain Burger King and Tim Hortons Inc, which runs coffee and doughnut shops.

Food industry experts see Kraft benefiting from Heinz's international presence, which generates more than 60% of its sales. Kraft brands are in 98% of North American households, the companies said, but would have a greater opportunity to expand overseas.

The combined company, which will be publicly traded under the name Kraft Heinz Co, expects to save about US$1.5 billion in annual costs by the end of 2017.

3G has a reputation for introducing aggressive cost cuts and improving efficiencies at other companies it has invested in, including Heinz and Anheuser-Busch InBev NV.

"Mature businesses look for cost cutting. 3G takes cost cutting to a different level," said Bob Goldin, executive vice president at food industry consultant Technomic. Goldin noted that neither Kraft nor Heinz are major players in the sector's growth segments, from organic to fresh foods.

The deal calls for the exchange of each Kraft share for one share in the combined Kraft Heinz Co, plus a special cash dividend of US$16.50 per share to existing Kraft shareholders. The US$10 billion behind the special dividend will be funded by an equity investment by Berkshire Hathaway and 3G.

Heinz shareholders will own 51% of the combined company and Kraft shareholders the rest. The transaction is worth about US$46 billion for Kraft shareholders, based on Kraft's market capitalization of US$36 billion on Tuesday before news of the deal emerged plus the special dividend.

Packaged-food makers from Kraft to General Mills and Kellogg are battling sluggish demand as consumers shift to brands that are perceived as healthier, including foods that are organic or less processed.

Kraft's efforts to revamp its own products, such as combining its higher-protein snacks like meat and nuts into one container called the P3 pack, have not shifted the tide enough.

In December, Kraft named John Cahill as chief executive, who acknowledged the company has not changed enough in the face of shifting consumer tastes. Cahill overhauled his leadership team last month, announcing the exit of three senior executives.

Cahill said on a call with analysts that 3G Managing Director Alex Behring approached him at the end of January about a possible deal. The discussions picked up in the second half of February.

While Kraft had been developing its own plan for change, the board saw the 3G opportunity as more compelling, said Cahill, who will be vice chairman of the combined company. Behring will serve as chairman of Kraft Heinz Co and Bernardo Hees, CEO of Heinz, will become CEO of the combined company.

Kraft Heinz Co will retain headquarters both in the Chicago area and in Pittsburgh. It will have combined revenue of about US$28 billion, about half that of market leader PepsiCo in 2014.

Berkshire Hathaway will own more than 320 million of the approximately 1.22 billion Kraft Heinz shares outstanding, Buffett told CNBC, adding "We will be in the stock forever."

"Heinz goes back to 1859," he said. "I think those tastes are pretty enduring. There will be plenty of people that want to eat other things, but there are many people who want to eat the products that Kraft/Heinz turn out"

The deal is unlikely to face regulatory hurdles as there is little overlap in products, antitrust experts said. Areas that could draw regulatory scrutiny include steak sauces - Kraft makes A1 and Heinz makes Lea & Perrins.

"Whatever divestitures there are will be easy, and they will be kind of minor," said Fiona Scott Morton, who teaches economics at the Yale University School of Management.

Industry watchers had speculated for months that 3G would buy another food company after the Heinz acquisition.

Kraft's appeal, according to some, is that its brands occupy shelf space in the center of many stores, just like Heinz. That could lead to cost savings in merchandising and sales.

Kraft is 3G Capital's fifth major deal in the food and beverage industry since 2008, when it engineered the takeover of Anheuser-Busch by brewer InBev.

3G Capital also controls Restaurant Brands International Inc , formed when Burger King business bought Canada's Tim Hortons. 3G Capital and Berkshire Hathaway acquired Heinz for US$23.2 billion in 2013.

Kraft split into two companies in 2012, with Kraft Foods focusing on grocery products in North America and Mondelez International Inc on snack products.

Lazard was Heinz's financial adviser, while Cravath, Swaine & Moore and Kirkland and Ellis were its legal advisers.

Centerview Partners LLC was Kraft's financial adviser and Sullivan & Cromwell its legal adviser.

↧

SINGAPORE: Prime Minister Datuk Seri Najib Razak paid his last respects to the late Lee Kuan Yew at Parliament House yesterday.

Speaking to reporters, Najib said that the late Lee Kuan Yew was a "great man whose leadership, vision, fortitude and perseverance helped shaped Singapore to what it is today: An advanced economy and finding its own place in the world".

"All Singaporeans owe him a huge debt of gratitude," he said. "Mr Lee also was a man who helped shape Southeast Asia as a region of peace and prosperity. He will go down as a great man of history, whose vision and leadership helped make this world a better place.

"I'd like to thank him for strengthening bilateral ties between Malaysia and Singapore," Najib said.

Najib also met Singapore Prime Minister Lee Hsien Loong to personally convey Malaysia’s condolences over the death of his father, who was Singapore’s first prime minister.

Najib was accompanied by his wife Datin Seri Rosmah Mansor, Foreign Affairs Minister Datuk Seri Anifah Aman, Transport Minister Datuk Seri Liow Tiong Lai, Natural Resources Minister Datuk Seri G.Palanivel and Minister in the Prime Minister’s Department Datuk Mah Siew Keong.

Malaysian High Commissioner to Singapore Datuk Husni Zai Yaacob was also in attendance.

In an emotional televised address, Lee Kuan Yew's son Prime Minister Lee Hsien Loong paid tribute to him. "He fought for our independence, built a nation where there was none, and made us proud to be Singaporeans. We won't see another man like him."

As we look back in history, back in 1960s, Lee Kuan Yew oversaw Singapore's independence from Britain and separation from Malaysia.

From then, Lee Kuan Yew became the island-state's prime minister for 31 years and was widely respected as the architect of Singapore's prosperity.

As early as 1973, Lee Kuan Yew had raised the idea of a free trade area and took every opportunity to promote trade within Asean.

This suited Singapore, which had pinned its survival on having one of the world's freest trade and investment regimes. Finally, after two decades of talks, the Asean Free Trade Area started to firm up in 1994.

Lee Kuan Yew's body is currently lying-in-state at the Parliament House at North Bridge Road. Lee, 91, passed away on March 23 at the Singapore General Hospital. He had been warded in the intensive care unit of the hospital since Feb 5 for severe pneumonia.

So far, the eulogies to Lee Kuan Yew from leaders of neighbouring countries are heartfelt. Lee Kuan Yew has certainly played an outsize role in building the stability and prosperity of this region.

Channel News Asia reported that the Yang di Pertuan Agong Tuanku Abdul Halim Mu'adzam Shah, Malaysia's King, will be among foreign dignitaries attending the late Lee Kuan Yew’s funeral this coming Sunday.

Others include former US president Bill Clinton who will lead the US delegation, former US secretary of state Henry Kissinger, Indonesia president Joko Widodo, South Korea president Park Geun Hye, Thailand's prime minister Prayut Chan-o-cha and India prime minister Narendra Modi.![]() |

| Malaysia Prime Minister Datuk Seri Najib Razak (centre right in black) with wife Datin Seri Rosmah Mansor (centre left in black) pay their respects to Singapore's first prime minister Lee Kuan Yew as he lies in state at the Singapore's Parliament House. The current Singapore Prime Minister Lee Hsien Loong and wife Ho Ching mourn the death of his father and her father-in-law. |

↧

KUALA LUMPUR: Malaysia's oil palm planters are bracing for a 3 per cent increase in production cost as the government impose the Goods and Services Tax (GST) effective April 1 as they are unable to fully pass on down the supply chain.

"By and large, we're putting in our best effort in bracing the GST. It is either zero or standard rated which will involve passing on throughout the supply chain and claimable tax input from the Customs Department," said newly-elected Malaysian Estate Owners Association president Joseph Tek.

In an interview with Business Times yesterday, he noted there will be a transitional phase in managing these changes at the initial stages.

He explained that there will be gaps in full and effective implementation of the GST because there are small and mid-sized planters in rural areas with limited connectivity and skilled human resource trained to manage these changes.

Some transactions which are currently computed on annual basis will now have to be carried out more frequently. There will be blocked input tax transactions from GST refunds of which planters will have no choice but to absorb the cost.

"Our experts have estimated that there will be marginal increase in cost of production .. around 3 per cent more. It will depend on the planters' resources rendered to the whole process. We implore upon the Customs Department to be our partners in managing changes involving GST," he said.

"Oil palm planters and rubber estate owners, who are our members, are very concerned about unabated cost acceleration in this commodity business. As farmers, we're price takers, we're not price makers," he added.

Last Friday, the third month benchmark palm oil futures on the Bursa Malaysia Derivatives Market fell RM22 to close at RM2,170 per tonne. Palm oil prices have not picked up as forecasted and fundamentals remain weak.

"Experts have estimated that for every ringgit we earned, oil palm planters are paying almost 40 sen to the federal and state governments in taxes," Tek said.

This amount covers statutory corporate taxes, cess for both MPOB and MPOC, palm oil stabilisation fund and others. The differences between Peninsular Malaysia, Sabah and Sarawak are the State Sales Taxes (applicable in Sabah and Sarawak) and Windfall Profit Levy at different price thresholds.

"We beseech the relevant authorities to appreciate the burden of ever increasing cost of production that is unfortunately not match with any significant increase in productivity," Tek said.

This is because, he explained, planters have spent a lot of money on amenities and benefits for employees, cost of guest workers legislation and minimum wages, capitalisation charges and trade stunting certification requirements imposed by developed nations.

Established in 1931, MEOA has survived more than eight decades of social tribulations and economic growth. Today, MEOA effectively represents key oil palm planters who are generating significant economic interests to Malaysia.

Last Friday, the very much respected Datuk Boon Weng Siew, aged 91, retired from leading MEOA, after 25 years of distinguished and selfless service. Long serving vice presidents Mark Chang Tek Mak and Tan Teo Kim have also resigned from their posts.

Tek, who succeeded Boon, noted this change of guard is a watershed for the oil palm and rubber sectors. Under Boon's leadership, MEOA has evolved from a ‘gentlemen’s club’ to an effective group representing the social and economic interests of small to medium-sized estate owners.

Effective last Friday, Tek's leadership of MEOA is supported by newly-elected vice presidents Jacqueline Foo Sueh Chuan and Gan Tee Jin.

"The oil palm industry is facing ever-more complex issues. It is only through a process of engagement and united stand that we can safeguard the viability of our industry, which is one of the least imports but biggest value adding contributors to our economy," Tek added.

↧

This is written by INDRA BALARATNAM.

WITH so much focus on eating healthy and obesity nowadays, fat has unfortunately gotten a bad reputation. The general perception is there’s no room for fat in your diet if you want to be thin.

It is this perception that I see as a huge obstacle to people wanting to even begin making dietary changes when told to do so by their doctor to manage their health condition. They assume the foods they’ll have to eat from will be hard, tasteless and downright excruciating to swallow.

The fat we eat — which we get naturally from meat, nuts, seeds, cooking oil, butter, margarine and dairy — helps our intestines to absorb Vitamins A, D, E and K, and antioxidant compounds found naturally in our foods.

These vitamins and compounds are soluble in fat, which then become the vehicle to enhance their absorption.

Fat is also needed for the healthy function of hormones and brain cells. Foods with fat are tasty and more appetising. A fatty meal takes longer to empty from the stomach during digestion, compared to just a high-carbohydrate meal, making you feel full longer.

Cooking oil is one of the main contributors of fat in our daily diet as we use oil to cook and flavour our foods. Different dishes — depending on their cooking method — require varying amounts of oil.

For example, a piece of deep fried fish would have more fat in it than a piece of steamed fish simply because deep frying requires a lot of oil to get the fish crispy. With such a dizzying array of cooking oils available, I’m sure you sometimes get a little confused about what to use.

Cooking oil is pressed and extracted from seeds and fruits that naturally yield oil. Depending on culture and cuisine, different oils are preferred in their cooking as it also adds to the taste and aroma.

Every type of cooking oil naturally has varying percentages of saturated, polyunsaturated and mono-unsaturated fatty acids in them as part of the molecular structure of a triglyceride. Fatty acids are the building blocks of fats. In fact, you may have noticed these words when you read the label of your cooking oil.

It is very common for cooking oils to be referred to by the largest percentage of the type of fatty acid it contains. For example, people will say that olive oil is a mono-unsaturated oil because the percentage of mono-unsaturated fatty acid is the highest compared to the saturated and polyunsaturated kind.

But that does not mean that if you chose olive oil, it does not have a certain amount of saturated and polyunsaturated fat as part of its make up.

The different amounts of fatty acids in the cooking oil determine their heat tolerance and therefore suitability of cooking methods. An oil that has more saturated fat is more stable and therefore ideal for stir-fry and deep-fry. Saturated oils such as coconut and palm cooking oil also have a longer shelf life.

Sunflower and canola oils that are predominantly poly-unsaturated are not as stable as saturated and mono-unsaturated oils. They are prone to turning rancid after being exposed to heat, light and oxygen. So, these oils should be served cold as salad dressing.

Because of this delicate structure, they are recommended to be used raw for making dressings or for very quick, low heat cooking. Oils with a higher mono-unsaturated fats are more stable than poly-unsaturated oils but are still not as stable as the saturated type.

The Malaysian Dietary Guidelines 2010 recommends that fat make up less than 30 per cent of your daily calorie requirements. That works out to be 67g for an averagely active person who consumes 2,000 calories per day.

A tablespoon of any type of cooking oil has 135 calories and 15g of fat. Oil is rich in calories and fat. So whatever type of cooking oil you use, it can make your dish high in calories .

So if you want to watch your overall fat intake, it is about choosing your foods and cooking methods wisely. If most of your meals are deep-fried or laden with cream, your fat intake will definitely exceed what your body requires for healthy function.

Try different styles of cooking such as steaming, blanching, braising, having a mix of cooked or raw vegetables such as salads and ulam. You could also consider making soup and lightly pan-fry your meals.

Here's a nifty tip. If you are going to have a heavy breakfast, then account for it and eat sparingly for lunch. Strike that smart balance!

↧

↧

PETALING JAYA: Boustead Plantations Bhd expects crude palm oil (CPO) prices to average RM2,300 to RM2,600 per tonne this year as buyers from China and India starts to replenish their vegetable oil stocks.

"Currently, CPO pricing is hovering around RM2,200 per tonne. It is facing some challenges as there is abundant supply of soybean, its biggest competitor," said Boustead vice chairman Tan Sri Lodin Wok Kamaruddin.

“Moving forward, we can expect CPO prices to trade higher as demand start to pick up. China and India, the world's most populous nations are likely to start buying more to replenish their stocks.

"Perhaps then we could see prices climb to between RM2,300 and RM2,600 per tonne,” Lodin said.

He expressed hope of better harvest for the year as more oil palm trees mature and bear more fruits.

The ongoing replanting programme to replace aging trees with high-yielding hybrids and clones supplied by its associate, Applied Agricultural Resources Sdn Bhd (AAR) will help raise yield at its estates.

AAR, an equal joint venture between Boustead Plantations Bhd and Kuala Lumpur Kepong Bhd (KLK), had been breeding hybrids for more than 25 years.

"Our high-yielding hybrid seeds are meticulously bred and cloned by AAR scientists," Lodin said, adding the hybrids have proven track records of producing more than 30 tonnes of fresh fruit bunches with 23 per cent oil extraction rate.

That works out to be about seven tonnes of oil per hectare in a year, almost two times higher than the country's average yield. Among the group's high yielding areas are its Sg Jernih and Segaria Estates.

Lodin noted AAR's palm breeding plan is to produce elite planting materials using marker assisted genome-wide selected palms. This, he said, will lead to a speedier and more precise prediction of superior parents for seed production.

AAR's designer seedlings and clonal materials are helping Boustead raise output and oil yield across its oil palm planted area of some 70,000 hectares.

Last month, Plantation Industries and Commodities Minister Datuk Amar Douglas Uggah Embas announced that the Malaysian Palm Oil Board (MPOB) will collaborate more closely with the police in enforcing against oil palm fruit theft.

For many years, disputes of ownership in Sarawak's native customary rights land has somewhat fueled unintended thefts of oil palm fruits.

Since such court cases are often entangled in political undercurrents, the palm oil industry suffered loss to pilferage amounting to tens of millions ringgit.

Last year, the minister said MPOB had issued 278 compounds, terminated three business licenses while imposing eight compounds on those found abetting pilferage of oil palm fruits.

Following the regulators commitment to step up enforcement, Boustead Plantations which have suffered from oil palm fruit thefts, may see more justified earnings from these disputed areas.

Lodin highlighted the courts have recently ruled in favour of Boustead Plantations at its disputed estates in Sarawak. Going forward, in all fairness, with better enforcement of the law by MPOB and the police, the group should be able to harvest all the oil palm fruits it is legally entitled to and therefore, post better earnings.

↧

KUALA LUMPUR: THE recently implemented Goods and Services Tax' (GST) will have minimal impact on the plantation sector, says analysts.

They expect planters like Felda Global Ventures Holdings Bhd, IOI Corp Bhd, Sime Darby Bhd, Sarawak Oil Palms Bhd, Kuala Lumpur Kepong Bhd, Genting Plantations Bhd, IJM Plantations Bhd and Hap Seng Plantations Holdings Bhd to be ready for the new tax structure.

On April 1, the 10 per cent Sales Tax and 6 per cent Service Tax was replaced with the 6 per cent GST.

"It is a complete pass-through for oil palm planters. Planters who are GST-registered with the Customs Department will be able to claim for every value-adding activity along the supply chain until the millers' gate," said an analyst.

When refiners buy crude palm oil from millers, they pay upfront. After processing the oil into cooking oil, oleochemicals and biodiesel, refiners export these value-added products from the seaport.

Since refiners are at the tail-end of 'export gate', they do not charge GST to overseas buyers when the refined oil is shipped out.

The timing difference between refiners paying the six per cent GST to the millers and claiming it back from the Customs Department is the funding period. If it takes too long, financially weaker refiners serving the export market, will face cash-flow problems.

In the domestic market, cooking oil re-packers under the Cooking Oil Price Stabilisation Scheme face the same fate, too.

These re-packers pay the six per cent GST upfront to the refiners but they are not able to pass it on to the retailers because cooking oil, sold at less than 20kg, is zero-rated.

"If cooking oil re-packers do not get their refunds on time, their margin will be squeezed and their cashflow affected.

"In the worst case scenario, re-packers may slow down and eventually stop packing the cooking oil, resulting in shortage of this kitchen staple at supermarket shelves," the analyst explained.

"In other words, it is crucial that the Customs Department process claims and refunds in a timely manner. Failure to do so will burden refiners and cooking oil repackers, thus unnecessarily raising their cost of doing business," he said.

CIMB Investment Bank analyst, Ivy Ng, is neutral about the GST impact on the plantation sector. "We see minimal negative impact on small planters who may not be GST-registered with the Customs Department."

"As for large planters who are GST-registered, there is no impact because they can pass it along the value chain and claim back input costs from the government," she said.

↧

Jakarta - (Bloomberg) Indonesia, the world’s biggest palm oil producer, will impose export levies to fund biodiesel subsidies, replanting, research and development.

Shippers will pay a levy of US$50 a ton for crude palm oil (CPO) and US$30 for refined oil starting this month, said Sofyan Djalil, coordinating minister for economic affairs.

The government will keep the threshold for application of a separate CPO export tax at US$750 a ton, Djalil said today.

Indonesia has promoted biofuel use to help absorb rising supplies of the world’s most-traded cooking oil and to cut carbon emissions. The country boosted the mandated amount of palm blending in diesel to 10 per cent from 7.5 per cent in 2013, and ordered power plants to mix 20 per cent in 2014.

The biodiesel subsidy was raised in February to 4,000 rupiah (31 U.S. cents) a liter from 1,500 rupiah and the mandated blending for diesel will be increased to 15 percent in April.

“The funds will be used to compensate the price differences between the regular diesel and biodiesel.” Djalil told reporters, referring to proceeds from the levy. “It will also be used to help in replanting, research and development and human resources development related to palm oil industry.”

The levy will be paid even when the export tax is at zero and will be “taken from export tax proceeds when prices are above US$750,” Djalil said on March 20.

The government sets the tax monthly, based on average prices in Jakarta, Rotterdam and Kuala Lumpur. Crude palm oil shipments attract no tax if the average is $750 or less over four weeks, with rates at 7.5 percent to 22.5 percent at higher prices.

Palm oil futures in Kuala Lumpur have fallen 18 per cent in the past year as a collapse in petroleum costs cut the appeal of cooking oils as biofuel.

Global supplies of soybeans, used to make an alternative oil, expanded to an all-time high. Futures retreated 6.1 per cent in March, the most since August, as soybeans and soybean oil dropped on expectations of record planting intentions in the U.S.

Ivy Ng, an analyst at CIMB Investment Bank Bhd. in Kuala Lumpur, said the decision might hurt Indonesian producers in the short term as domestic prices could decline.

“Local prices of crude palm oil will fall by close to US$50 per ton while processed palm oil in local market will fall by US$30 per ton,” Ng said by phone on Saturday. “In three to six months time if the biodiesel program becomes really successful then prices may recover.”

Indonesia has maintained zero tax on most palm oil shipments for seven months through April because the reference price stayed below the US$750 threshold, the Trade Ministry said March 30.

The government decree regarding this new levy is expected to be signed on April 6 or 7 and the ruling will become effective upon signing, Djalil said.

↧