BANGI, Selangor: MALAYSIA will impose a 4.5 per cent export duty on crude palm oil (CPO) for April 2015, after seven months of duty-free CPO since September 2014, following higher prices.

The CPO price averaged RM2,288.41 a tonne in the past month, which surpassed the threshold for CPO tax of RM2,250 per tonne.

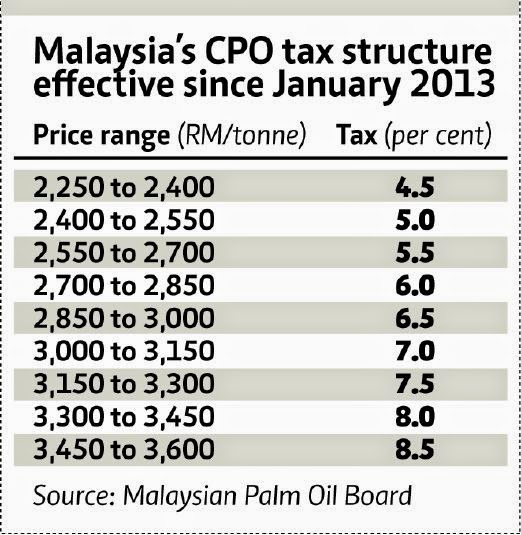

“Since the average pricing in the past month is well within the RM2,400 a tonne bandwidth, the CPO tax is 4.5 per cent,” said Plantation Industry and Commodities Minister Datuk Amar Douglas Uggah Embas.

Refined palm oil will, however, remain tax-free, the minister told reporters after hosting a visit by Iranian Members of Parliament to the Malaysian Palm Oil Board headquarters, here, yesterday.

To recap, should the next one-month trading of CPO ending April 15 averages below RM2,250, there will be no tax on CPO exports for the month of May.

Malaysia’s multi-tiered CPO export tax, effective since January 2013, is structured in such a way to mimic Indonesia’s.

The Palm Oil Refiners Association of Malaysia (Poram) had previously said that Malaysia’s CPO tax structure needs to move in lock-step with Indonesia.

That way, Malaysia’s refiners can continue to compete on a level playing field and hopefully, oil palm planters in both Malaysia and Indonesia can avoid the dreaded price war.

If Indonesia was to widen the tax gap between crude and refined oil by a certain percentage, Malaysia’s CPO tax should be immediately amended to match the gap. This will allow oleochemical and specialty fats producers here to also benefit from the competitive prices.

Analysts see the government’s move as a commitment to ensure “a level playing field with rivals” to maintain the country’s export competitiveness. Many foreign and local downstream investors have injected billions of ringgit in investments to produce specialty fats, specialty oleochemicals and fine chemicals.

Maybank Investment Bank analyst Ong Chee Ting said: “We believe this CPO tax imposition is positive for the industry as this brings hope that exports for processed palm oil could pick up again from April 2015, after a sharp decline in recent months.”

“The CPO export tax will give refiners some incentives to ramp up utilisation rates which fell below 50 per cent in February 2015,” the analyst added.

From August 2014 until February 2015, CPO prices traded on lacklustre sentiment, averaging below the tax threshold of RM2,250 per tonne. Yesterday, the third month benchmark palm oil futures on the Bursa Malaysia Derivatives market closed RM37 lower at RM2,199 per tonne.

Brokerage KL Palm Services Sdn Bhd, which deals with traders from plantation companies of Malaysia and Indonesia as well as palm oil buyers in China, India, Europe and the United States, highlighted pessimistic palm oil prices for the past couple of weeks.

“Palm oil prices are likely to be under pressure from weak demand because there is still ample stocks at consuming countries. So far, Malaysia’s palm oil production is good. We foresee double-digit growth in output until May,” said KL Palm Services managing director Ling Chen Eng.

“For Indonesia, we estimate palm oil production to pick up from April until July. Palm oil stocks in Malaysia and Indonesia are expected to build up fast in the next few months,” he said.

“Currently, we see many large trading companies placing long positions in their books. We think CPO prices are not likely to rise as long as refiners and oleochemical producers suffer from negative processing margins. How many sectors do you know of that can survive in this scenario?” Ling asked.

The CPO price averaged RM2,288.41 a tonne in the past month, which surpassed the threshold for CPO tax of RM2,250 per tonne.

“Since the average pricing in the past month is well within the RM2,400 a tonne bandwidth, the CPO tax is 4.5 per cent,” said Plantation Industry and Commodities Minister Datuk Amar Douglas Uggah Embas.

Refined palm oil will, however, remain tax-free, the minister told reporters after hosting a visit by Iranian Members of Parliament to the Malaysian Palm Oil Board headquarters, here, yesterday.

To recap, should the next one-month trading of CPO ending April 15 averages below RM2,250, there will be no tax on CPO exports for the month of May.

Malaysia’s multi-tiered CPO export tax, effective since January 2013, is structured in such a way to mimic Indonesia’s.

The Palm Oil Refiners Association of Malaysia (Poram) had previously said that Malaysia’s CPO tax structure needs to move in lock-step with Indonesia.

That way, Malaysia’s refiners can continue to compete on a level playing field and hopefully, oil palm planters in both Malaysia and Indonesia can avoid the dreaded price war.

If Indonesia was to widen the tax gap between crude and refined oil by a certain percentage, Malaysia’s CPO tax should be immediately amended to match the gap. This will allow oleochemical and specialty fats producers here to also benefit from the competitive prices.

Analysts see the government’s move as a commitment to ensure “a level playing field with rivals” to maintain the country’s export competitiveness. Many foreign and local downstream investors have injected billions of ringgit in investments to produce specialty fats, specialty oleochemicals and fine chemicals.

Maybank Investment Bank analyst Ong Chee Ting said: “We believe this CPO tax imposition is positive for the industry as this brings hope that exports for processed palm oil could pick up again from April 2015, after a sharp decline in recent months.”

“The CPO export tax will give refiners some incentives to ramp up utilisation rates which fell below 50 per cent in February 2015,” the analyst added.

From August 2014 until February 2015, CPO prices traded on lacklustre sentiment, averaging below the tax threshold of RM2,250 per tonne. Yesterday, the third month benchmark palm oil futures on the Bursa Malaysia Derivatives market closed RM37 lower at RM2,199 per tonne.

Brokerage KL Palm Services Sdn Bhd, which deals with traders from plantation companies of Malaysia and Indonesia as well as palm oil buyers in China, India, Europe and the United States, highlighted pessimistic palm oil prices for the past couple of weeks.

“Palm oil prices are likely to be under pressure from weak demand because there is still ample stocks at consuming countries. So far, Malaysia’s palm oil production is good. We foresee double-digit growth in output until May,” said KL Palm Services managing director Ling Chen Eng.

“For Indonesia, we estimate palm oil production to pick up from April until July. Palm oil stocks in Malaysia and Indonesia are expected to build up fast in the next few months,” he said.

“Currently, we see many large trading companies placing long positions in their books. We think CPO prices are not likely to rise as long as refiners and oleochemical producers suffer from negative processing margins. How many sectors do you know of that can survive in this scenario?” Ling asked.